When it comes to real estate investing, understanding cap rates (or capitalization rates) is essential. Cap rates are a key indicator of a property’s profitability, market value, and investment potential. Whether you’re new to real estate or an experienced investor, knowing how cap rates work can make a significant difference in your investment decisions. Here’s a breakdown of four reasons why understanding cap rates should be at the top of your priority list.

Evaluate Profitability and Return on Investment

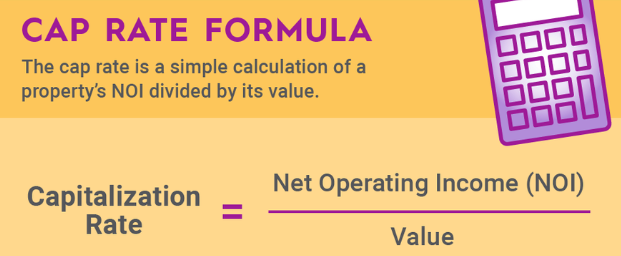

Cap rates allow investors to evaluate the profitability of commercial real estate properties. Essentially, a cap rate is a ratio that compares a property’s net operating income (NOI) to its current market value. The formula for calculating a cap rate is straightforward:

Cap Rate=Net Operating Income (NOI)/Property Value

By understanding cap rates, you can assess a property’s income potential:

Higher cap rates indicate a higher potential return but may also come with increased risk.

Lower cap rates usually mean the property is in a less risky, stable market but may offer lower returns.

Comparing cap rates between properties helps investors see where their money may yield the highest return and aligns with their risk tolerance.

Determine Property Valuation

Cap rates are a common tool for estimating the value of income-producing properties. To find a property’s market value, divide the net operating income by the cap rate. This calculation is essential for determining if a property is reasonably priced:

Property Value=Net Operating Income (NOI)/Cap Rate

For example, if a property generates $100,000 in NOI and has a cap rate of 8%, its estimated value would be:

100,000/0.08=1,250,000

Understanding cap rates helps investors and appraisers verify that a property’s price aligns with market standards, ensuring that an investment isn’t overpriced or undervalued.

Gauge Market Trends and Assess Risks

Cap rates are not static—they change in response to market trends, economic shifts, and investor sentiment. By keeping an eye on cap rate trends, you gain valuable insights into the health of the real estate market:

Decreasing cap rates often signals a competitive market, where demand for properties is high, driving prices up.

Increasing cap rates may indicate a market slowdown or higher risk, suggesting that investors are more cautious.

Analyzing cap rate trends helps investors make informed decisions on timing their purchases or sales, as well as understanding the relative stability or volatility of different market segments.

Guide Financing and Lending Decisions

Cap rates are also a critical factor for lenders assessing loan applications for income-producing properties. Banks and other financial institutions look at cap rates to determine the feasibility of a loan and often set requirements for minimum cap rates. A favorable cap rate can help borrowers secure better loan terms and interest rates.

For investors, understanding cap rates means you can enter negotiations with a clear sense of how your property compares to lending criteria, increasing your chances of favorable financing options.

Conclusion: Make Smarter Real Estate Investments

Cap rates are more than just a metric; they’re a powerful tool for evaluating potential profitability, market trends, and financing options. By understanding cap rates and how they interact with other metrics like cash-on-cash return and IRR, you can make smarter investment decisions, negotiate better loan terms, and stay ahead of market trends.

Whether you’re buying, selling, or seeking financing, a strong grasp of cap rates empowers you to navigate the real estate market with confidence and clarity.

Real Estate in Action: At Aarcstone Capital Partners, we use cap rate analysis to help our investors identify stable, high-performing assets that align with their risk tolerance and financial goals.

Ready to build your real estate portfolio with expert guidance?

Visit Aarcstone Capital Partners today and succeed in the ever-evolving world of real estate investing!