Investing for retirement can often feel like a daunting task, especially when traditional IRAs yield meager returns. However, self-directed IRAs (SDIRAs) offer a compelling alternative for those looking to take control of their retirement savings and explore diverse investment opportunities. In this comprehensive guide, we will delve into the power of self-directed IRAs, focusing particularly on multifamily real estate investing—a strategy that has transformed the financial futures of many investors, including myself.

What is a Self-Directed IRA?

A self-directed IRA is a type of individual retirement account that allows investors to choose their investments beyond the typical stocks and bonds. With an SDIRA, you can invest in a variety of alternative assets, such as real estate, private equity, precious metals, and more. This flexibility can lead to higher returns and greater diversification in your retirement portfolio.

Key Advantages of Self-Directed IRAs

Investment Control: Unlike traditional IRAs, SDIRAs empower you to make your own investment decisions, allowing you to invest in what you know and understand.

Diverse Investment Options: You can invest in a wide range of assets, including multifamily real estate, which can provide consistent rental income within the SDIRA and potential appreciation over time.

Tax Benefits: SDIRAs offer the same tax advantages as traditional IRAs, meaning your investments can grow tax-deferred or tax-free, depending on the type of account you choose. However, it’s important to remember that all income generated must remain in the SDIRA until retirement age to avoid penalties.

<< Book A Call >>

Multifamily Real Estate Investing: A Profitable Strategy

Multifamily real estate investing is one of the most attractive options for SDIRA investors. Here’s why:

- Steady Income Stream:

Investing in multifamily properties can generate consistent rental income. However, this cash flow must remain within the SDIRA and cannot be accessed until you reach retirement age (typically 59 ½) without incurring penalties. - Appreciation Potential:

Real estate values tend to appreciate over time, providing an opportunity for significant capital gains. As property values increase, so does your investment’s worth, enhancing your retirement savings within the SDIRA. - Tax Advantages:

Real estate investments come with various tax benefits, including depreciation, which can help reduce your taxable income within the SDIRA. Additionally, profits from rental income are tax-deferred or tax-free within the account, maximizing your investment growth. However, you cannot use these tax advantages for personal gain until you are eligible to withdraw funds from the SDIRA.

How to Get Started with a Self-Directed IRA

Step 1: Choose a Custodian

To open an SDIRA, you must select a custodian who specializes in alternative investments. This custodian will manage your account and ensure compliance with IRS regulations.

Step 2: Fund Your Account

You can fund your SDIRA through contributions, transfers from existing retirement accounts, or rollovers. Ensure you understand the contribution limits and eligibility requirements.

Step 3: Identify Investment Opportunities

Once your account is funded, you can begin identifying investment opportunities. Research potential multifamily properties, analyze their financials, and conduct due diligence to ensure they align with your investment goals.

Expert Guidance and Resources

To further enhance your understanding of self-directed IRAs and multifamily investing, consider downloading our free eBook, “The Comprehensive Guide to Self-Directed IRAs: Unleashing the Power of Alternative Investments.” This resource includes:

- In-depth Analysis: Learn about the advantages and disadvantages of SDIRAs compared to traditional IRAs.

- Proven Strategies: Discover effective strategies for identifying and acquiring profitable multifamily properties.

- Case Studies: Gain insights from real investors who have successfully navigated the self-directed IRA landscape and achieved their financial goals.

- Actionable Steps: Get practical advice on building a team of trusted advisors to support your investment journey.

Conclusion

Self-directed IRAs represent a powerful tool for investors seeking to diversify their retirement portfolios and maximize returns. By embracing alternative investments like multifamily real estate, you can unlock the potential for higher passive income and significant capital appreciation within your retirement account. However, it is crucial to understand that any income generated must remain in the SDIRA until retirement age to avoid penalties. Don’t miss the opportunity to learn from experts in the field—download your free eBook today and start your journey toward financial independence!

Frequently Asked Questions (FAQs)

- Can I use the income from my Self-Directed IRA before retirement?

No, any income generated from investments within a Self-Directed IRA must remain in the account until you reach the eligible retirement age. Withdrawing funds early can lead to penalties and taxes. - What happens if I withdraw funds from my SDIRA before retirement?

Early withdrawals from an SDIRA are subject to income taxes and a 10% penalty if you are under the age of 59 ½. It’s crucial to plan your investments with this in mind to avoid unexpected tax consequences. - Can I manage the properties I invest in through my SDIRA?

No, the IRS prohibits self-dealing, meaning you cannot personally manage or benefit from the properties or assets held in your SDIRA. All management and income must be handled by the custodian, and income must stay within the account. - Are there any risks associated with using an SDIRA for real estate investing?

Yes, while SDIRAs offer greater investment flexibility, they also come with increased complexity and risks. You must comply with strict IRS regulations, and any mistakes could result in significant penalties or disqualification of the account.

Introduction to Multifamily Real Estate Syndication

Welcome to the exciting world of multifamily real estate syndication, a realm where collaboration, strategy, and smart investing converge to create remarkable opportunities for investors like you. Whether you’re a seasoned investor or just starting, this guide will illuminate the path to potentially lucrative and wise investments in real estate syndication.

Real Estate Syndication

Why Consider Multifamily Real Estate Syndication?

Imagine having the key to unlock larger, more lucrative real estate deals that were previously out of reach. Multifamily real estate syndication does exactly that. By pooling resources with other investors, you gain access to significant commercial real estate opportunities, tapping into markets that promise higher returns and greater growth potential.

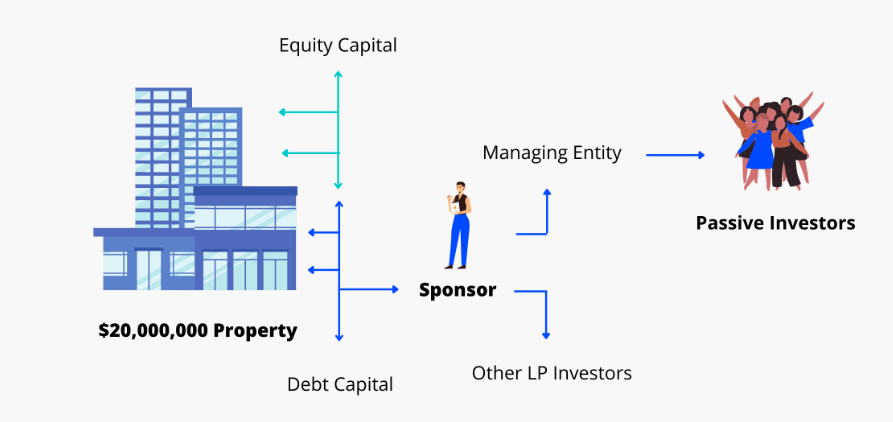

The Synergy of General and Limited Partnerships

At the heart of a real estate syndication is the synergy between two groups: the General Partners (GPs) and the Limited Partners (LPs). The GPs are the strategists and managers, steering the ship with their expertise in property management, while the LPs contribute financially without the hassle of day-to-day management. This structure allows you to invest passively, reaping the benefits of real estate without the typical burdens of property ownership.

The Power of a Limited Liability Company (LLC)

By forming an LLC, both GPs and LPs create a robust framework for holding and managing the property. This legal structure not only streamlines the investment process but also offers you protection and peace of mind.

Consistent Returns and Financial Growth

One of the most attractive aspects of multifamily syndication is the potential for consistent, quarterly cash flow distributions. As a passive investor, you can enjoy a steady stream of income while the property appreciates in value under the expert management of the GPs.

The Final Flourish: Sale and Profit Sharing

The journey culminates with the strategic sale of the property. After enhancing its value and achieving the investment objectives, the property is sold. This is where you, as an investor, see the fruition of your investment – the return of your initial capital and a share in the profits.

Related Investing in Multifamily: A Manual for 2024

Why Multifamily Syndication Stands Out

1. Access to Bigger Deals: Step into the realm of significant commercial properties.

2. Diversification: Spread your investments, reducing risk.

3. Ease of Investment: Share responsibilities, focusing on what you do best.

4. Tax Advantages: Leverage tax benefits to maximize your returns.

Multifamily real estate syndication is more than just an investment; it’s a journey towards financial growth, a pathway to diversify your portfolio, and an opportunity to be part of something bigger. Ready to unlock the door to your real estate investing future? Join the world of multifamily syndication and watch your investment dreams turn into reality.