Real estate syndications have become an increasingly popular investment vehicle, allowing investors to pool their resources and participate in larger, more lucrative projects. One of the key components of a successful syndication is the waterfall structure, which determines how profits and returns are distributed among the various stakeholders.

What is a Waterfall Structure in Real Estate?

A waterfall structure is a financial model that outlines the order and distribution of funds or proceeds from an investment or business venture. In the context of real estate syndications, the waterfall structure specifies how profits or returns are allocated among the participants involved, such as the sponsor, general partners, and limited partners.

The waterfall structure typically consists of different tiers or levels, where each participant or stakeholder receives a specified portion of the profits based on predetermined criteria. These criteria can include return thresholds, preferred returns, and hurdle rates. The sponsor or general partner is often incentivized to achieve higher returns for investors by receiving a larger share of the profits once certain thresholds are met.

Common Waterfall Structures

There are several common waterfall structures used in real estate syndications:

- Basic Waterfall Structure: In this structure, the preferred return is paid to the investors first, and once that is achieved, the profits are split between the investors and the sponsor according to a predetermined percentage split.

- European Waterfall Structure: In this structure, the preferred return is accumulated until the end of the investment period, and then the profits are split between the investors and the sponsor according to a predetermined percentage split.

- American Waterfall Structure: In this structure, the preferred return is paid to the investors first, and then the profits are split between the investors and the sponsor according to a predetermined percentage split. However, the sponsor has the option to “catch up” to a predetermined percentage of the total profits, even if the investors have already received their preferred return.

- Double-Tiered Waterfall Structure: This structure includes two separate tiers of preferred returns. The first tier is paid to the investors until a certain rate of return is achieved, after which the second tier of preferred return is paid to the investors until a higher rate of return is achieved. Once both tiers of preferred return are met, the profits are split between the investors and the sponsor according to a predetermined percentage split.

- Lookback Waterfall Structure: This structure takes into account the cumulative performance of the investment over time. The preferred return is calculated based on the net profits earned by the partnership, which are then distributed to the investors according to their percentage ownership in the partnership. The investor with the lowest cumulative return receives the first priority for any profits above the preferred return, followed by the investor with the next lowest cumulative return, and so on until all investors have received the preferred return.

Recent Trends and Considerations

In recent years, there has been a growing trend towards more complex and customized waterfall structures in real estate syndications. Some sponsors are experimenting with multi-tiered structures, incorporating additional hurdles and profit splits to further align the interests of the sponsor and investors.

However, it’s important to note that while complex structures may seem appealing, they can also increase the administrative burden and potential for disputes. Investors should carefully review and understand the waterfall structure before committing to syndication, ensuring that it aligns with their investment goals and risk tolerance.

Conclusion

The waterfall structure is a critical component of real estate syndications, as it determines how profits and returns are distributed among the various stakeholders. By understanding the different types of waterfall structures and their implications, investors can make more informed decisions and participate in syndications that offer the best potential for returns while aligning with their investment objectives.

Ready to learn how waterfall structures can impact your returns? Schedule a call with us today to get started!

FAQs

- What is the most common preferred return in real estate syndications?

The most common preferred return is 8%, although some deals may offer a lower 7% return. It’s unlikely to see rates over 10%, although some unique projects might go as high as 22%. - How do waterfall structures align the interests of sponsors and investors?

Waterfall structures align interests by incentivizing sponsors to achieve higher returns for investors. Once certain thresholds are met, sponsors receive a larger share of the profits, motivating them to outperform and maximize returns for all partners. - Can waterfall structures be changed after a syndication is formed?

Waterfall structures are typically set in stone once a syndication is formed and are seldom altered. Sponsors create a structure that works for them and their investors, and it is rare for these to be changed. - What percentage of real estate syndications use a two-tiered waterfall structure?

Approximately 24% of real estate syndications use a two-tiered waterfall structure, making it one of the more common variations after the basic waterfall structure. - What are some benefits of using real estate waterfall software?

Real estate waterfall software, such as the Cascade Suite by Deloitte, can help implement a waterfall distribution model with little to no technical expertise required. These tools allow users to simply plug in relevant names and data to calculate the complex payouts.

Introduction to Multifamily Real Estate Syndication

Welcome to the exciting world of multifamily real estate syndication, a realm where collaboration, strategy, and smart investing converge to create remarkable opportunities for investors like you. Whether you’re a seasoned investor or just starting, this guide will illuminate the path to potentially lucrative and wise investments in real estate syndication.

Real Estate Syndication

Why Consider Multifamily Real Estate Syndication?

Imagine having the key to unlock larger, more lucrative real estate deals that were previously out of reach. Multifamily real estate syndication does exactly that. By pooling resources with other investors, you gain access to significant commercial real estate opportunities, tapping into markets that promise higher returns and greater growth potential.

The Synergy of General and Limited Partnerships

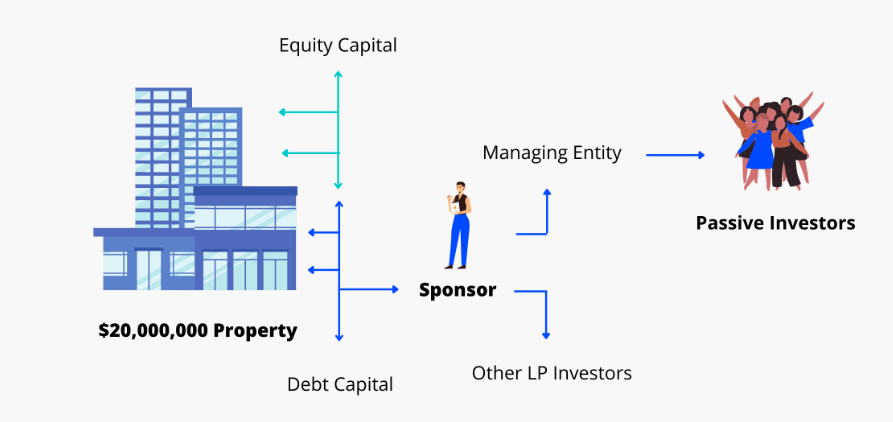

At the heart of a real estate syndication is the synergy between two groups: the General Partners (GPs) and the Limited Partners (LPs). The GPs are the strategists and managers, steering the ship with their expertise in property management, while the LPs contribute financially without the hassle of day-to-day management. This structure allows you to invest passively, reaping the benefits of real estate without the typical burdens of property ownership.

The Power of a Limited Liability Company (LLC)

By forming an LLC, both GPs and LPs create a robust framework for holding and managing the property. This legal structure not only streamlines the investment process but also offers you protection and peace of mind.

Consistent Returns and Financial Growth

One of the most attractive aspects of multifamily syndication is the potential for consistent, quarterly cash flow distributions. As a passive investor, you can enjoy a steady stream of income while the property appreciates in value under the expert management of the GPs.

The Final Flourish: Sale and Profit Sharing

The journey culminates with the strategic sale of the property. After enhancing its value and achieving the investment objectives, the property is sold. This is where you, as an investor, see the fruition of your investment – the return of your initial capital and a share in the profits.

Related Investing in Multifamily: A Manual for 2024

Why Multifamily Syndication Stands Out

1. Access to Bigger Deals: Step into the realm of significant commercial properties.

2. Diversification: Spread your investments, reducing risk.

3. Ease of Investment: Share responsibilities, focusing on what you do best.

4. Tax Advantages: Leverage tax benefits to maximize your returns.

Multifamily real estate syndication is more than just an investment; it’s a journey towards financial growth, a pathway to diversify your portfolio, and an opportunity to be part of something bigger. Ready to unlock the door to your real estate investing future? Join the world of multifamily syndication and watch your investment dreams turn into reality.