What is Cost Segregation?

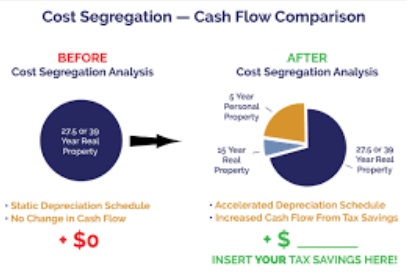

Cost segregation is a strategic tax planning method that enables real estate investors to accelerate depreciation deductions on their properties. By identifying and reclassifying various components of a property, such as personal property and land improvements, into shorter depreciation periods, investors can significantly enhance their cash flow and reduce tax liabilities. This approach allows for more substantial deductions in the early years of property ownership, providing immediate financial benefits.

How Cost Segregation Works

Identifying Property Components

The initial step in a cost segregation study is a detailed analysis of the property to identify its various components, including:

- Personal Property: Items like furniture, fixtures, and equipment that can be depreciated over a shorter period.

- Land Improvements: Enhancements made to the land, such as landscaping, parking lots, and sidewalks, which qualify for accelerated depreciation.

Reclassifying Assets

After identification, components are reclassified into different categories based on their useful life. This reclassification leverages shorter depreciation schedules, often ranging from 5 to 15 years, compared to the standard 27.5 or 39 years for residential and commercial properties, respectively.

Benefits of Cost Segregation

1. Increased Cash Flow

Accelerating depreciation through cost segregation allows for significant tax deferrals in the initial ownership years. For example, reclassifying $1 million in assets, assuming a marginal tax rate of 35%, could lead to potential tax deferrals of up to $350,000. This does not generate new cash but conserves it by reducing the amount of tax payable. As a result, investors might find themselves with more available cash that can be reinvested or allocated to other financial needs.

2. Reduced Tax Liabilities

By reclassifying assets into shorter depreciation periods, investors benefit from accelerated depreciation deductions, leading to substantial tax savings and freeing up capital for reinvestment.

3. Improved Return on Investment (ROI)

Maximizing depreciation deductions through cost segregation boosts cash flow, which can be utilized for property improvements, debt reduction, or further investments, potentially enhancing overall investment returns.

4. Strategic Tax Planning

Cost segregation facilitates better tax planning by enabling property owners to implement various tax strategies effectively, such as utilizing bonus depreciation, Section 179 expensing, and partial asset disposition elections. This leads to optimized tax outcomes and supports more informed investment decisions.

Who Should Consider Cost Segregation?

Real Estate Investors

Real estate investors, especially those owning multifamily properties, commercial buildings, or large-scale developments, can benefit significantly from cost segregation. The potential for substantial tax savings makes this strategy particularly appealing for those looking to maximize their investments.

High-Income Earners

Individuals or businesses in higher tax brackets will find cost segregation especially advantageous. The ability to reduce taxable income through accelerated depreciation can lead to significant tax savings, making it a valuable strategy for wealth management.

Related – Unlocking the Potential of Multifamily Real Estate Syndication

Conducting a Cost Segregation Study

Importance of Professional Guidance

Compliance with IRS regulations and accurate asset classification is critical, necessitating the involvement of qualified professionals such as engineers and tax specialists who specialize in cost segregation.

Steps Involved in a Cost Segregation Study

- Initial Property Assessment: Thorough examination of the property to identify components.

- Detailed Analysis: Breakdown of costs associated with each component and their respective useful lives.

- Report Generation: Production of a comprehensive report detailing findings, classifications, and recommended depreciation schedules.

Conclusion

Cost segregation is a powerful tool for real estate investors aiming to maximize tax benefits and improve financial performance. By engaging qualified professionals for a detailed cost segregation study, investors can unlock significant cash flow benefits, reduce tax liabilities, and better support their long-term investment goals in the competitive real estate market. This strategy not only provides strategic financial relief but also enhances the management of investment capital.

Schedule a call now and take the first step towards optimizing your investments!

As the world evolves, so does the real estate landscape, particularly in the multifamily sector. In 2024, various trends reshape how developers, investors, and residents perceive and engage with multifamily properties. From technological advancements to shifting demographics, here are five emerging trends in multifamily real estate for 2024.

Sustainable Living Spaces:

With a growing focus on environmental sustainability, multifamily properties are adapting to incorporate eco-friendly features and practices. Developers are increasingly integrating renewable energy sources such as solar panels, implementing energy-efficient appliances, and incorporating green spaces within communities. Additionally, initiatives like water conservation measures and waste reduction strategies are becoming standard in multifamily developments. Sustainable living spaces appeal to environmentally conscious tenants and contribute to cost savings and long-term value for property owners.

Smart Building Technologies:

Advancements in technology are revolutionizing multifamily real estate with the integration of smart building technologies. From smart thermostats and automated lighting systems to keyless entry and remote property management platforms, these technologies enhance convenience, security, and efficiency for residents and property managers. IoT (Internet of Things) devices enable real-time monitoring and control of various building systems, optimizing resource usage and improving overall tenant experience. As the demand for connected living spaces grows, expect widespread adoption of smart building solutions across multifamily properties in 2024 and beyond.

Flexibility in Design and Amenities:

The preferences and lifestyles of renters are evolving, driving the need for greater flexibility in multifamily property design and amenities. Developers focus on creating versatile living spaces that accommodate diverse tenant demographics and changing needs. This includes flexible floor plans that easily adapt to different living arrangements, such as co-living or multigenerational housing setups. Additionally, communal amenities like coworking spaces, fitness centers, and pet-friendly facilities are gaining popularity as tenants prioritize convenience and social connectivity. By offering a mix of amenities and flexible living options, multifamily properties can attract a wider range of tenants and foster a sense of community.

Rise of Urban Suburbs:

Urban suburbs are gaining traction as more people seek the benefits of suburban living without sacrificing urban conveniences. These mixed-use developments combine elements of both urban and suburban environments, offering walkable neighborhoods with access to retail, dining, and entertainment options. With the rise of remote work and flexible schedules, urban suburbs provide an attractive alternative for renters looking to balance city living and suburban tranquility. Multifamily developers are capitalizing on this trend by investing in suburban markets with strong job growth and transportation infrastructure, creating vibrant communities that cater to modern urban dwellers.

Emphasis on Health and Wellness:

The COVID-19 pandemic has heightened awareness of health and wellness concerns, prompting multifamily properties to prioritize resident safety and well-being. In 2024, expect to see an increased focus on health-centric design features and amenities, such as air purification systems, outdoor recreation areas, and wellness programming. Properties that promote physical and mental well-being will appeal to health-conscious tenants seeking a holistic living experience. Additionally, integrating telehealth services and fitness technology platforms allows residents to prioritize their health from the comfort of their homes. By prioritizing health and wellness initiatives, multifamily properties can differentiate themselves in a competitive market and attract discerning renters.

Conclusion:

The multifamily real estate landscape is evolving rapidly, driven by technological innovations, demographic shifts, and changing consumer preferences. In 2024, sustainability, technology, flexibility, urban suburbs, and health and wellness will emerge as key trends shaping the future of multifamily properties. By embracing these trends, developers and investors can capitalize on opportunities to create innovative, resilient communities that meet the evolving needs of tenants in the years to come.