The “2024 Multifamily Outlook” anticipates moderating economic conditions leading to 2024. It predicts a soft landing with slowed yet positive growth in jobs, wages, and GDP, alongside decreasing inflation. The multifamily market is expected to be sluggish due to peak deliveries of new supply. Rent growth is projected to be positive but below the long-term average, with higher vacancy rates. Stabilizing interest rates should help balance cap rates and property values, encouraging more transaction volume.

Read the full report (Source: Freddie Mac)

Multifamily Performance in 2024

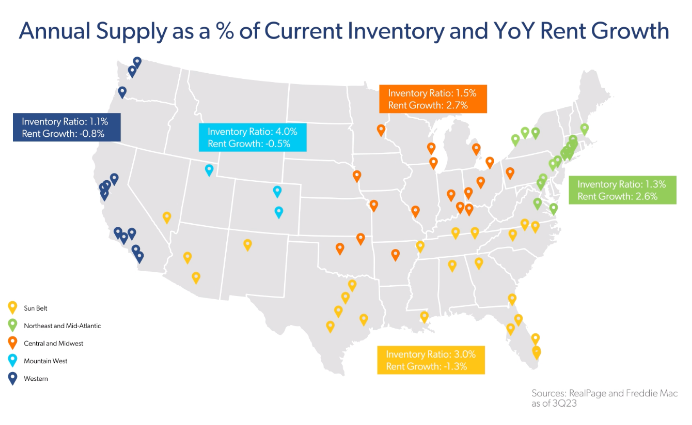

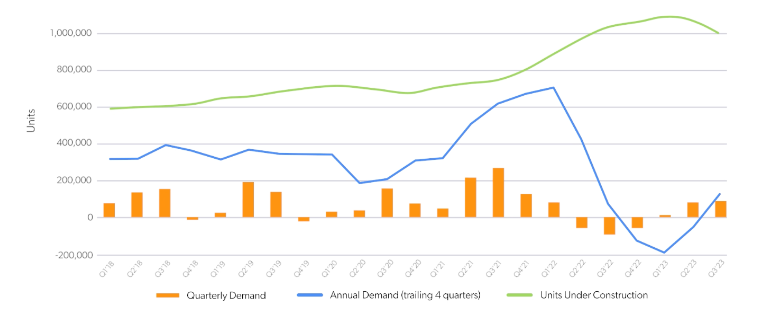

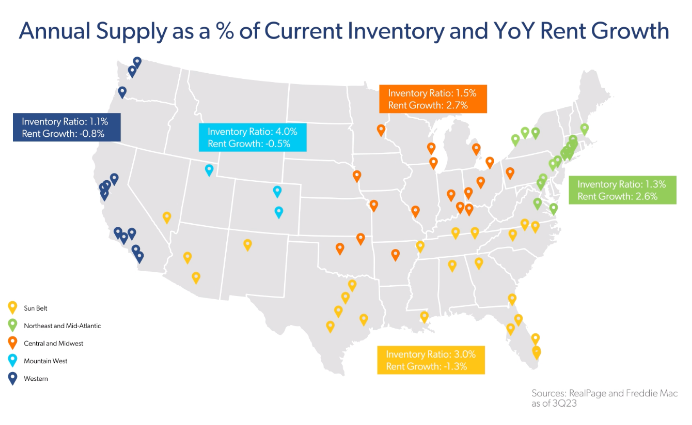

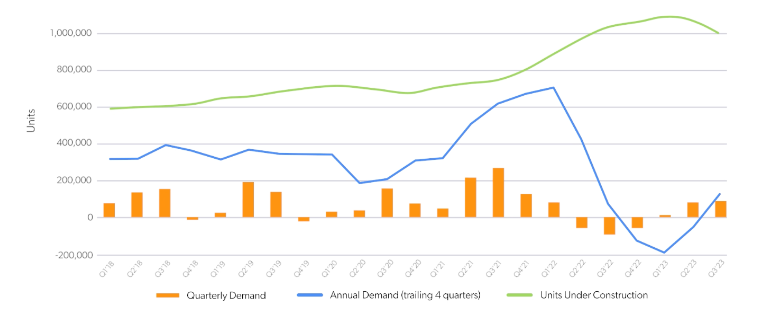

In light of a potential economic soft landing, we anticipate that the multifamily real estate market will experience gradual growth, albeit at a slower pace, as it absorbs the significant influx of new supply expected in 2024. As the broader economy decelerates, resulting in a less robust labor market, the demand for multifamily housing is expected to remain positive but somewhat weaker compared to the pre-pandemic era.

For the year 2024, our baseline projection indicates a 2.5% increase in rental rates, which remains slightly below the long-term annual average spanning from 2000 to 2022, standing at 2.9% according to RealPage data. We also anticipate that the vacancy rate will remain relatively stable in 2024, despite the projected peak in new property deliveries for this cycle. Specifically, we forecast a 5.7% vacancy rate for 2024, which is 40 basis points higher than the 5.3% Real Page average recorded from 2000 through 2022.

However, if the economy fails to achieve a soft landing and instead plunges into a recession, the multifamily market could experience significantly weaker performance. Regardless of economic conditions, the pipeline of multifamily units expected to be completed this year remains quite robust. If demand were to wane due to a recession, it could exert upward pressure on vacancy rates while pushing rents downward. This scenario is particularly relevant for markets facing an excessive influx of new supply.

Moderate Origination Volume Projections

In 2023, the multifamily valuation and debt market exhibited sluggishness, primarily due to the persistent and volatile interest rate environment. Despite efforts by the Federal Reserve to combat high inflation rates, the initial hope for declining interest rates or a recession leading to lower rates did not materialize. Consequently, multifamily originations declined throughout the year as many investors remained cautious amidst the rate fluctuations.

The stabilization of interest rates, all else being equal, is expected to facilitate transactions by bringing buyers and sellers closer to mutually agreeable terms. However, the combination of slower rent growth and a higher interest rate environment may continue to exert downward pressure on multifamily property valuations in 2024. These factors are expected to impede a swift return to the origination levels witnessed in 2021-2022. Consequently, Freddie Mac anticipates a modest increase in origination volume, projecting a rise of approximately 30-33%, reaching a range of $370 billion to $380 billion in 2024. This level is more in line with pre-pandemic origination figures.

Despite short-term challenges related to supply, the multifamily market’s long-term prospects remain favorable. It will continue to benefit from the persistent housing shortage, an expensive for-sale housing market, and the entry of the next generation of renters, Generation Z, into their prime renting years.

The “2024 Multifamily Outlook” anticipates moderating economic conditions leading to 2024. It predicts a soft landing with slowed yet positive growth in jobs, wages, and GDP, alongside decreasing inflation. The multifamily market is expected to be sluggish due to peak deliveries of new supply. Rent growth is projected to be positive but below the long-term average, with higher vacancy rates. Stabilizing interest rates should help balance cap rates and property values, encouraging more transaction volume.

Read the full report (Source: Freddie Mac)

Multifamily Performance in 2024

In light of a potential economic soft landing, we anticipate that the multifamily real estate market will experience gradual growth, albeit at a slower pace, as it absorbs the significant influx of new supply expected in 2024. As the broader economy decelerates, resulting in a less robust labor market, the demand for multifamily housing is expected to remain positive but somewhat weaker compared to the pre-pandemic era.

For the year 2024, our baseline projection indicates a 2.5% increase in rental rates, which remains slightly below the long-term annual average spanning from 2000 to 2022, standing at 2.9% according to RealPage data. We also anticipate that the vacancy rate will remain relatively stable in 2024, despite the projected peak in new property deliveries for this cycle. Specifically, we forecast a 5.7% vacancy rate for 2024, which is 40 basis points higher than the 5.3% Real Page average recorded from 2000 through 2022.

However, if the economy fails to achieve a soft landing and instead plunges into a recession, the multifamily market could experience significantly weaker performance. Regardless of economic conditions, the pipeline of multifamily units expected to be completed this year remains quite robust. If demand were to wane due to a recession, it could exert upward pressure on vacancy rates while pushing rents downward. This scenario is particularly relevant for markets facing an excessive influx of new supply.

Moderate Origination Volume Projections

In 2023, the multifamily valuation and debt market exhibited sluggishness, primarily due to the persistent and volatile interest rate environment. Despite efforts by the Federal Reserve to combat high inflation rates, the initial hope for declining interest rates or a recession leading to lower rates did not materialize. Consequently, multifamily originations declined throughout the year as many investors remained cautious amidst the rate fluctuations.

The stabilization of interest rates, all else being equal, is expected to facilitate transactions by bringing buyers and sellers closer to mutually agreeable terms. However, the combination of slower rent growth and a higher interest rate environment may continue to exert downward pressure on multifamily property valuations in 2024. These factors are expected to impede a swift return to the origination levels witnessed in 2021-2022. Consequently, Freddie Mac anticipates a modest increase in origination volume, projecting a rise of approximately 30-33%, reaching a range of $370 billion to $380 billion in 2024. This level is more in line with pre-pandemic origination figures.

Despite short-term challenges related to supply, the multifamily market’s long-term prospects remain favorable. It will continue to benefit from the persistent housing shortage, an expensive for-sale housing market, and the entry of the next generation of renters, Generation Z, into their prime renting years.

Read more Investing in Multifamily: A Manual for 2024 – Aarcstone Capital Partners![]()