Identifying emerging markets for real estate investing in multifamily properties is a strategic endeavor that can yield significant returns. As the demand for rental housing continues to rise, understanding how to pinpoint these markets is crucial for investors looking to capitalize on growth opportunities. This blog will explore effective strategies for identifying promising multifamily real estate markets in the USA.

Emerging Markets For Real Estate Investing In Multifamily

Analyzing Economic Indicators

The first step in identifying emerging markets is to analyze key economic indicators. Look for regions experiencing robust economic growth, characterized by:

- Increasing Employment Opportunities: Areas with new businesses and industries moving in often lead to job creation, which drives housing demand. For instance, cities like Austin, Nebraska, and Greenville, South Carolina, have shown significant economic expansion, making them attractive for multifamily investments in 2024.

- Population Growth: A rising population indicates a growing demand for housing, especially in urban areas where multifamily properties are prevalent. The Triangle area in North Carolina has become a hotspot for young professionals due to its vibrant job market and lifestyle options.

- GDP Growth: Regions with strong GDP growth often see increased investment and development, which can lead to higher property values and rental demand. In 2024, cities like Austin, Texas, and Raleigh, North Carolina, are projected to have some of the highest GDP growth rates in the country.

Studying Demographic Trends

Understanding demographic shifts is vital. Focus on areas with:

- Young, Growing Populations: Millennials and Gen Z are increasingly renting rather than buying homes, creating demand for multifamily units. The Triangle area in North Carolina has seen a significant influx of young professionals in recent years.

- Urbanization Patterns: Regions experiencing urban migration often see a spike in rental demand as people seek proximity to jobs and amenities. Cities like Denver, Colorado, and Seattle, Washington, have seen rapid urbanization in the past decade.

Changing Lifestyle Preferences: As remote work becomes more prevalent, people are prioritizing quality of life factors like outdoor recreation and work-life balance. This trend has contributed to population growth in areas like Raleigh, Durham, and Charlotte in North Carolina.

Evaluating Infrastructure and Development Projects

Infrastructure plays a crucial role in determining a market’s potential. Look for:

- Significant Infrastructure Investments: Cities investing in transportation, commercial developments, and public services are likely to attract new residents. Cities like Wilmington, North Carolina, are investing heavily in their infrastructure, which supports future growth in multifamily housing.

- Revitalization Initiatives: Areas undergoing redevelopment often see increased property values and rental demand. The Bricktown neighborhood in Oklahoma City, Oklahoma, has undergone significant revitalization in recent years, attracting new residents and businesses.

- Proximity to Major Hubs: Being close to major airports, highways, and public transportation can make a market more attractive to investors and tenants alike. Cities like Phoenix, Arizona, and Las Vegas, Nevada, have benefited from their proximity to major transportation hubs.

Examining Rental Market Fundamentals

Before investing, assess the local rental market by examining:

- Rental Demand and Vacancy Rates: Low vacancy rates and high rental demand indicate a healthy market. Knoxville, Tennessee, has maintained a high occupancy rate, making it an attractive market for multifamily investments.

- Rental Price Trends: Rising rents can signal a strong demand for multifamily housing. In 2024, cities like Tampa, Florida, and Boise, Idaho, are expected to see some of the highest rent growth in the country.

- Affordability: As housing costs continue to rise, affordability becomes an increasingly important factor for renters. Markets with a mix of affordable and luxury housing options may be more attractive to a wider range of tenants.

Reviewing the Regulatory Environment

Understanding local regulations is essential

- Zoning Laws: Favorable zoning laws can facilitate multifamily developments. Some cities, like Minneapolis, Minnesota, have implemented policies to encourage the construction of more affordable housing units.

- Tax Incentives: Areas offering tax breaks for developers can enhance profitability. States like Texas and Florida have no state income tax, making them attractive for real estate investors.

- Rent Control Policies: Some markets have implemented rent control policies, which can impact the profitability of multifamily investments. Investors should carefully consider the potential impact of these policies on their investments.

Considering Proximity to Amenities

The location of multifamily properties is crucial for attracting tenants. Look for:

- Access to Schools and Universities: Areas with reputable educational institutions are often more desirable for families and students. Cities like Austin, Texas, and Raleigh, North Carolina, are home to several top-ranked universities, which can drive rental demand.

- Nearby Amenities: Proximity to shopping, healthcare, and recreational facilities can enhance the appeal of your property. Investing in areas with strong amenities can lead to higher tenant retention rates and rental income.

- Walkability and Bikeability: As more people prioritize sustainability and healthy lifestyles, walkable and bikeable neighborhoods are becoming increasingly popular. Cities like Portland, Oregon, and Seattle, Washington, have invested heavily in pedestrian and bike infrastructure.

Connecting with Local Real Estate Professionals

Networking with local real estate experts can provide invaluable insights. Engage with:

- Real Estate Agents: They can offer information on emerging neighborhoods and market conditions. Building relationships with local agents can help you stay ahead of the curve and identify promising investment opportunities.

- Property Managers: Their experience can help identify potential investment opportunities. Property managers can provide valuable insights into tenant preferences, rental rates, and market trends.

- Local Developers: Connecting with developers who are active in the market can provide insights into upcoming projects and future growth plans. Collaborating with developers can also open up opportunities for joint ventures or co-investments

Conclusion

Identifying emerging markets for multifamily real estate investing requires a multifaceted approach. By analyzing economic indicators, demographic trends, infrastructure developments, rental market fundamentals, and regulatory environments, investors can uncover lucrative opportunities. Remember, thorough due diligence and local insights are key to successful investments.

Are you ready to explore the exciting world of multifamily real estate investing? Contact us today to learn more about emerging markets and how we can help you achieve your investment goals!

FAQs

- What are the key indicators of an emerging real estate market?

Key indicators include economic growth, increasing employment opportunities, population growth, and infrastructure development.

- Why is demographic analysis important in real estate investing?

Demographic analysis helps identify trends in rental demand, particularly among younger populations who are more likely to rent.

- How can I assess the rental market fundamentals?

Evaluate local vacancy rates, rental demand, and price trends to gauge the health of the rental market.

- What role do local regulations play in real estate investing?

Local regulations, including zoning laws and tax incentives, can significantly impact the feasibility and profitability of multifamily investments.

- How can networking with local professionals benefit my investments?

Local real estate professionals provide insights into market conditions, emerging neighborhoods, and investment opportunities that can enhance your investment strategy.

Introduction to Multifamily Real Estate Syndication

Welcome to the exciting world of multifamily real estate syndication, a realm where collaboration, strategy, and smart investing converge to create remarkable opportunities for investors like you. Whether you’re a seasoned investor or just starting, this guide will illuminate the path to potentially lucrative and wise investments in real estate syndication.

Real Estate Syndication

Why Consider Multifamily Real Estate Syndication?

Imagine having the key to unlock larger, more lucrative real estate deals that were previously out of reach. Multifamily real estate syndication does exactly that. By pooling resources with other investors, you gain access to significant commercial real estate opportunities, tapping into markets that promise higher returns and greater growth potential.

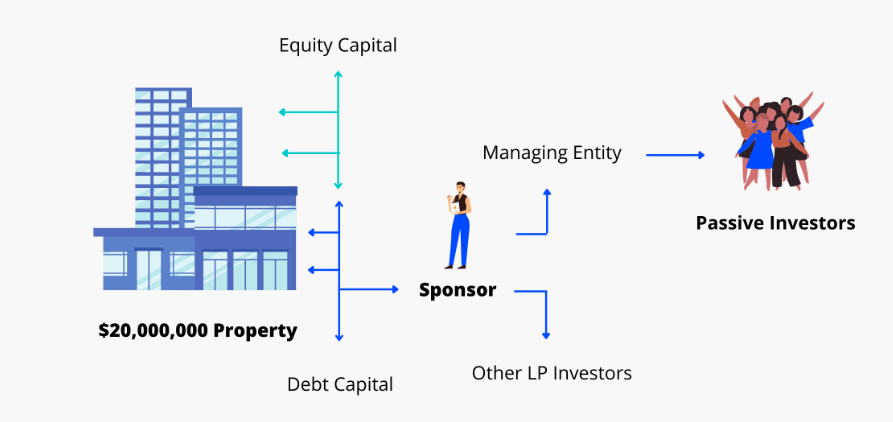

The Synergy of General and Limited Partnerships

At the heart of a real estate syndication is the synergy between two groups: the General Partners (GPs) and the Limited Partners (LPs). The GPs are the strategists and managers, steering the ship with their expertise in property management, while the LPs contribute financially without the hassle of day-to-day management. This structure allows you to invest passively, reaping the benefits of real estate without the typical burdens of property ownership.

The Power of a Limited Liability Company (LLC)

By forming an LLC, both GPs and LPs create a robust framework for holding and managing the property. This legal structure not only streamlines the investment process but also offers you protection and peace of mind.

Consistent Returns and Financial Growth

One of the most attractive aspects of multifamily syndication is the potential for consistent, quarterly cash flow distributions. As a passive investor, you can enjoy a steady stream of income while the property appreciates in value under the expert management of the GPs.

The Final Flourish: Sale and Profit Sharing

The journey culminates with the strategic sale of the property. After enhancing its value and achieving the investment objectives, the property is sold. This is where you, as an investor, see the fruition of your investment – the return of your initial capital and a share in the profits.

Related Investing in Multifamily: A Manual for 2024

Why Multifamily Syndication Stands Out

1. Access to Bigger Deals: Step into the realm of significant commercial properties.

2. Diversification: Spread your investments, reducing risk.

3. Ease of Investment: Share responsibilities, focusing on what you do best.

4. Tax Advantages: Leverage tax benefits to maximize your returns.

Multifamily real estate syndication is more than just an investment; it’s a journey towards financial growth, a pathway to diversify your portfolio, and an opportunity to be part of something bigger. Ready to unlock the door to your real estate investing future? Join the world of multifamily syndication and watch your investment dreams turn into reality.