The challenges faced by the multifamily real estate sector over the past 18 months, including expanded cap rates, plummeting values, and interest rate hikes that jeopardized numerous deals, savvy investors are positioning themselves for a potential gold rush in 2024. While rising interest rates and soaring construction costs have undoubtedly put pressure on the industry, the fundamentals remain strong, and opportunities abound for those with a keen eye for value and the ability to weather short-term storms.

At Arcstone Capital Partners, a leading real estate investing firm specializing in multifamily investments, we believe that multifamily real estate investments in 2024 will offer a unique opportunity for investors to capitalize on a market primed for recovery. Here’s why

The 2024 Multifamily Gold Rush

Positive Rent Growth Forecast

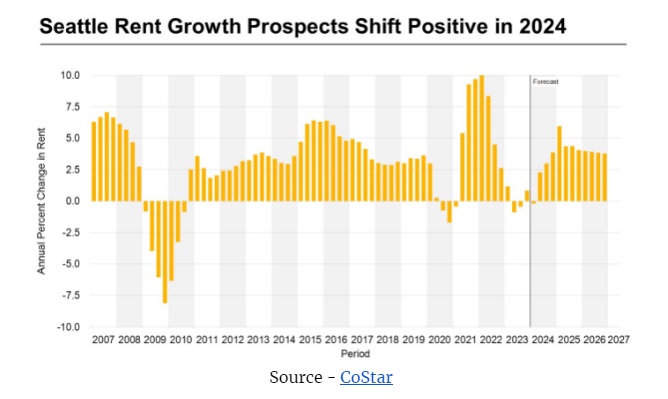

While a significant supply of over 500,000 new units is expected to hit the market in 2024, the demand for rental housing remains robust, driven by structural shifts in the housing market. Factors such as the influx of work-from-home employees seeking more spacious accommodations and the continued unaffordability of single-family homes are fueling demand for multifamily housing. According to industry data from sources like Yardi Matrix, renting is currently 52% less expensive than buying a house – the largest gap in history. As a result, reputable data providers project positive rent growth of 1.5% in 2024, even with the new supply entering the market.

Easing Expense Pressures

While operating expenses have undoubtedly soared in recent years, driven by factors like rising insurance costs, property taxes, contractor labor rates, materials prices, and utilities, there are signs that the pace of growth is slowing. As inflation moderates from its peak, expense growth is expected to return to more historical norms in 2024, providing relief for multifamily Investors. Additionally, as homeownership costs increase with mortgage rates, landlords have greater flexibility to pass on higher expenses to tenants, who are often faced with limited alternatives in the current housing market.

Interest Rate Relief and Recession Outlook

Most economists and the Federal Reserve anticipate that interest rates will decline in 2024, with mortgage rates potentially dropping below 6% from their current elevated levels. This assessment is based on the expectation that the Fed will successfully bring inflation under control and begin easing its monetary policy stance. Furthermore, with the U.S. economy demonstrating resilience in critical indicators like GDP growth and job creation and the Fed signaling a willingness to reduce rates and maintain its balance sheet, the likelihood of a significant recession before the 2024 election appears diminished.

Lender Cooperation Amid Market Conditions

Lenders have learned valuable lessons from the 2008 financial crisis. They are now more willing to work with operators facing financial difficulties directly related to market conditions, such as higher interest rates and rate cap costs. This collaborative approach starkly contrasts the wave of foreclosures that occurred during the previous downturn when lenders were often quick to seize assets. Coupled with recent government directives urging lenders to support credit-worthy borrowers, this lender cooperation could limit the number of foreclosures and prevent a meltdown in the multifamily sector during the current cycle.

More Than Just Cash Flow

Contrary to popular belief, cash flow is one of many reasons investors are drawn to multifamily real estate. Many limited partners who provide substantial capital for these investments view them as a long-term play. These sophisticated investors, often high-net-worth individuals or institutions, seek to build a nest egg for retirement or generate profits over a multi-year horizon of 3 to 10 years or more. With multifamily values having plummeted by a staggering 25% to 35% in the past 18 months, 2024 could present a rare opportunity to “buy low” and position for solid returns in the years ahead as the market recovers.

Conclusion:

While 2024 may not be a banner year for all multifamily Investors, particularly those who acquired properties at peak valuations between 2020 and 2022, the data and historical precedent suggest that it presents a unique opportunity for investors to position themselves for long-term growth. With values depressed, rents projected to rise, expenses moderating, interest rates declining, and lenders demonstrating flexibility, the stars are aligning for a potential multifamily real estate gold rush in 2024. At Arcstone Capital Partners, we are here to help to navigate this dynamic market. We leverage our deep industry expertise and extensive network to uncover the most promising multifamily real estate investments for 2024 and beyond.

FAQs

FAQ 1: How is the outlook for rent growth in 2024 despite the new supply coming online?Answer: Major data providers project around 1.5% rent growth in 2024, as robust demand from factors like work-from-home needs and unaffordable homeownership is expected to outpace new supply.

FAQ 2: What signs indicate expense pressures may start easing for multifamily Investors in 2024?

Answer: As inflation moderates from recent peaks, expense growth is projected to return to more historical norms, providing relief especially on costs like insurance, taxes, labor, and materials.

FAQ 3: Why is the risk of a major recession before the 2024 election seen as low?

Answer: The resilient U.S. economy, Fed signaling policy easing, and historical trends of the Fed avoiding disruptions around elections reduces the likelihood of a sharp downturn.

As the world evolves, so does the real estate landscape, particularly in the multifamily sector. In 2024, various trends reshape how developers, investors, and residents perceive and engage with multifamily properties. From technological advancements to shifting demographics, here are five emerging trends in multifamily real estate for 2024.

Sustainable Living Spaces:

With a growing focus on environmental sustainability, multifamily properties are adapting to incorporate eco-friendly features and practices. Developers are increasingly integrating renewable energy sources such as solar panels, implementing energy-efficient appliances, and incorporating green spaces within communities. Additionally, initiatives like water conservation measures and waste reduction strategies are becoming standard in multifamily developments. Sustainable living spaces appeal to environmentally conscious tenants and contribute to cost savings and long-term value for property owners.

Smart Building Technologies:

Advancements in technology are revolutionizing multifamily real estate with the integration of smart building technologies. From smart thermostats and automated lighting systems to keyless entry and remote property management platforms, these technologies enhance convenience, security, and efficiency for residents and property managers. IoT (Internet of Things) devices enable real-time monitoring and control of various building systems, optimizing resource usage and improving overall tenant experience. As the demand for connected living spaces grows, expect widespread adoption of smart building solutions across multifamily properties in 2024 and beyond.

Flexibility in Design and Amenities:

The preferences and lifestyles of renters are evolving, driving the need for greater flexibility in multifamily property design and amenities. Developers focus on creating versatile living spaces that accommodate diverse tenant demographics and changing needs. This includes flexible floor plans that easily adapt to different living arrangements, such as co-living or multigenerational housing setups. Additionally, communal amenities like coworking spaces, fitness centers, and pet-friendly facilities are gaining popularity as tenants prioritize convenience and social connectivity. By offering a mix of amenities and flexible living options, multifamily properties can attract a wider range of tenants and foster a sense of community.

Rise of Urban Suburbs:

Urban suburbs are gaining traction as more people seek the benefits of suburban living without sacrificing urban conveniences. These mixed-use developments combine elements of both urban and suburban environments, offering walkable neighborhoods with access to retail, dining, and entertainment options. With the rise of remote work and flexible schedules, urban suburbs provide an attractive alternative for renters looking to balance city living and suburban tranquility. Multifamily developers are capitalizing on this trend by investing in suburban markets with strong job growth and transportation infrastructure, creating vibrant communities that cater to modern urban dwellers.

Emphasis on Health and Wellness:

The COVID-19 pandemic has heightened awareness of health and wellness concerns, prompting multifamily properties to prioritize resident safety and well-being. In 2024, expect to see an increased focus on health-centric design features and amenities, such as air purification systems, outdoor recreation areas, and wellness programming. Properties that promote physical and mental well-being will appeal to health-conscious tenants seeking a holistic living experience. Additionally, integrating telehealth services and fitness technology platforms allows residents to prioritize their health from the comfort of their homes. By prioritizing health and wellness initiatives, multifamily properties can differentiate themselves in a competitive market and attract discerning renters.

Conclusion:

The multifamily real estate landscape is evolving rapidly, driven by technological innovations, demographic shifts, and changing consumer preferences. In 2024, sustainability, technology, flexibility, urban suburbs, and health and wellness will emerge as key trends shaping the future of multifamily properties. By embracing these trends, developers and investors can capitalize on opportunities to create innovative, resilient communities that meet the evolving needs of tenants in the years to come.