Recession indicators are vital economic metrics that provide insights into the health of an economy, helping investors, analysts, and policymakers anticipate potential downturns. Understanding these indicators is essential for making informed decisions in both personal finance and business strategy, especially during periods of uncertainty. This blog explores the key recession indicators, their implications, and recent trends that highlight their significance in today’s economic landscape.

Recession indicators are vital economic metrics that provide insights into the health of an economy, helping investors, analysts, and policymakers anticipate potential downturns. Understanding these indicators is essential for making informed decisions in both personal finance and business strategy, especially during periods of uncertainty. This blog explores the key recession indicators, their implications, and recent trends that highlight their significance in today’s economic landscape.

Key Recession Indicators

Recession indicators are a subset of economic signals that reveal the likelihood, presence, or severity of an economic slowdown. While there are numerous metrics available, some of the most commonly cited indicators include:

Gross Domestic Product (GDP)

A significant decline in GDP over consecutive quarters is a primary indicator of recession. It reflects reduced economic activity, negatively affecting businesses, employment, and consumer spending. However, it’s important to note that GDP data is often revised. Economists focus on sustained declines over time, rather than one or two quarters of negative growth, to assess the severity of economic contraction.

Unemployment Rates

Rising unemployment is a traditional indicator of economic slowdown. Increasing job losses often suggest businesses are cutting back due to reduced demand, and this weakened consumer confidence translates into less spending power. Cyclical industries like manufacturing and retail typically see early job losses, while more stable sectors, such as healthcare and utilities, may fare better during the initial stages of a recession.

Consumer Spending

A slowdown in consumer spending is a strong signal of an impending recession. When consumers become cautious about their finances, they cut back on discretionary purchases, which impacts industries like retail, hospitality, and travel. However, consumer spending doesn’t drop immediately in response to economic uncertainty—households may rely on savings or credit to maintain spending in the short term. Consumer sentiment surveys, like the University of Michigan’s Consumer Sentiment Index, often provide an early warning before actual spending cuts begin.

Stock Market Performance

Stock market indices like the S&P 500 and the Dow Jones Industrial Average can reflect investor sentiment and economic health. Sharp declines may indicate investor pessimism about the future, but it’s important to recognize that stock market volatility doesn’t always align perfectly with recessions. Geopolitical events, corporate earnings reports, and even global trade issues can drive market fluctuations, sometimes independent of the broader economy’s health.

Business Investment

Decreased business investment is a clear signal of economic uncertainty. Companies may delay or cancel capital expenditure projects when faced with lower demand or concerns about profitability. Corporate earnings trends often serve as an early warning—when profits shrink, businesses typically reduce investment, which in turn slows economic growth and innovation.

Yield Curve Inversion

The yield curve, which compares interest rates on short-term and long-term government bonds, is a highly reliable predictor of recessions. An inverted yield curve—where long-term rates fall below short-term rates—has historically preceded recessions by anywhere from 6 to 24 months. This inversion signals that investors expect slower growth and lower interest rates in the future, reflecting broader economic pessimism.

Read More – Why Investing in Athens, Georgia is a Smart Move in 2024

Recent Trends and Developments (As of 2024)

As of 2024, several recent trends have raised concerns about the potential for an economic downturn:

GDP Fluctuations

Recent GDP data has shown fluctuations, with some quarters experiencing contractions, raising concerns about a possible technical recession. However, analysts are closely monitoring for sustained declines, which would confirm a deeper recessionary trend.

Unemployment Rates

While the labor market remains relatively strong, some sectors—especially those sensitive to interest rate hikes, such as construction and real estate—have seen rising unemployment. This trend, if sustained, could lead to reduced consumer spending, amplifying the risk of a broader economic downturn.

Consumer Confidence

Consumer confidence surveys have indicated a growing sense of caution, which often precedes reduced spending. Although households have maintained spending levels through savings and credit, a continued dip in confidence could trigger a slowdown in consumer activity, deepening recession risks.

Stock Market Volatility

Stock markets have experienced significant volatility in recent months, driven by global uncertainty, inflation concerns, and aggressive central bank actions. Although the markets often react to a wide range of factors, prolonged volatility can signal a broader economic downturn, particularly if it coincides with other recession indicators.

Inverted Yield Curve

The yield curve has inverted in recent months, a historically reliable predictor of future recessions. While this doesn’t guarantee an immediate downturn, it suggests that investors expect economic growth to slow, likely driven by tighter monetary policies and rising interest rates.

Implications of Recession Indicators

The implications of these recession indicators are profound, particularly for businesses, investors, and policymakers. Understanding these indicators allows for proactive responses to economic shifts:

- Increased Unemployment

Recessions typically lead to higher unemployment, as businesses cut back on labor costs in response to reduced demand. This results in lower consumer spending and further deepens economic slowdowns.

- Decreased Business Investment

During recessions, companies often delay or cancel investments in new projects, which limits economic growth. This slowdown can stifle innovation and cause ripple effects across various industries.

- Financial Market Instability

Recessions lead to increased volatility in financial markets, with stock prices often declining due to investor uncertainty. This instability can reduce capital flows into key sectors, impacting long-term economic growth.

- Policy Responses

Governments and central banks may implement fiscal and monetary measures to counter recessionary effects. Central banks often reduce interest rates to stimulate borrowing and investment, while governments may deploy stimulus packages to encourage consumer spending and business investment.

FAQs

- What is the definition of a recession?

A recession is typically defined as a significant decline in economic activity spread across the economy, lasting more than a few months. This is commonly identified by two consecutive quarters of negative GDP growth.

- How do recession indicators help in predicting economic downturns?

Recession indicators provide insights into various aspects of the economy, such as employment, consumer spending, and business investment. Analyzing these indicators collectively helps assess the likelihood of an impending recession.

- What is the significance of the yield curve in predicting recessions?

An inverted yield curve, where long-term bond yields fall below short-term yields, has historically been a reliable predictor of recessions, often signaling downturns 6 to 24 months in advance.

- Can a recession be avoided?

While it’s difficult to avoid recessions entirely, proactive fiscal and monetary policies can mitigate their impacts. Monitoring recession indicators allows governments and central banks to take timely action to soften the blow and shorten the recession’s duration.

Learn about how recession indicators can impact your financial future. Contact us today to learn more!

Introduction to Multifamily Real Estate Syndication

Welcome to the exciting world of multifamily real estate syndication, a realm where collaboration, strategy, and smart investing converge to create remarkable opportunities for investors like you. Whether you’re a seasoned investor or just starting, this guide will illuminate the path to potentially lucrative and wise investments in real estate syndication.

Real Estate Syndication

Why Consider Multifamily Real Estate Syndication?

Imagine having the key to unlock larger, more lucrative real estate deals that were previously out of reach. Multifamily real estate syndication does exactly that. By pooling resources with other investors, you gain access to significant commercial real estate opportunities, tapping into markets that promise higher returns and greater growth potential.

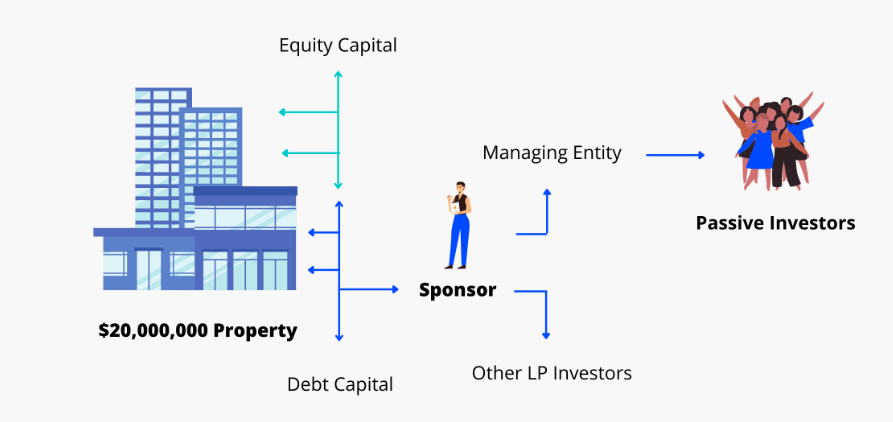

The Synergy of General and Limited Partnerships

At the heart of a real estate syndication is the synergy between two groups: the General Partners (GPs) and the Limited Partners (LPs). The GPs are the strategists and managers, steering the ship with their expertise in property management, while the LPs contribute financially without the hassle of day-to-day management. This structure allows you to invest passively, reaping the benefits of real estate without the typical burdens of property ownership.

The Power of a Limited Liability Company (LLC)

By forming an LLC, both GPs and LPs create a robust framework for holding and managing the property. This legal structure not only streamlines the investment process but also offers you protection and peace of mind.

Consistent Returns and Financial Growth

One of the most attractive aspects of multifamily syndication is the potential for consistent, quarterly cash flow distributions. As a passive investor, you can enjoy a steady stream of income while the property appreciates in value under the expert management of the GPs.

The Final Flourish: Sale and Profit Sharing

The journey culminates with the strategic sale of the property. After enhancing its value and achieving the investment objectives, the property is sold. This is where you, as an investor, see the fruition of your investment – the return of your initial capital and a share in the profits.

Related Investing in Multifamily: A Manual for 2024

Why Multifamily Syndication Stands Out

1. Access to Bigger Deals: Step into the realm of significant commercial properties.

2. Diversification: Spread your investments, reducing risk.

3. Ease of Investment: Share responsibilities, focusing on what you do best.

4. Tax Advantages: Leverage tax benefits to maximize your returns.

Multifamily real estate syndication is more than just an investment; it’s a journey towards financial growth, a pathway to diversify your portfolio, and an opportunity to be part of something bigger. Ready to unlock the door to your real estate investing future? Join the world of multifamily syndication and watch your investment dreams turn into reality.