Multifamily real estate syndication has become an increasingly popular investment strategy, offering investors the opportunity to pool their resources and capitalize on the potential of the multifamily market. However, not all syndication deals are created equal, and investors need to understand the different types of deals available to make informed decisions.

In this comprehensive guide, we’ll explore the four main deal types in multifamily syndication and provide insights on how to identify them. By understanding the unique characteristics and risks associated with each deal type, investors can make more informed decisions and potentially maximize their returns.

The Four Deal Types in Multifamily Syndication

1. Value-Add Deals

Value-add deals focus on properties that can be improved through renovations, operational enhancements, or repositioning. These properties often have below-market rents or deferred maintenance issues. Investors typically seek to implement renovations and operational improvements to increase cash flow and property value over time.

Identifying Value-Add Deals:

- Look for properties with below-market rents compared to similar units in the area.

- Assess the condition of the property for deferred maintenance.

- Evaluate the current management practices to identify operational inefficiencies.

2. Core Deals

Core deals involve stabilized properties that generate steady cash flow with minimal risk. These properties are usually located in desirable areas with strong market fundamentals, such as high occupancy rates and consistent rental demand. Investors looking for lower-risk investments often prefer core deals.

Identifying Core Deals:

- Focus on properties in prime locations with high demand and low vacancy rates.

- Analyze historical performance data to ensure steady cash flow.

- Review the property’s financials for stability and predictability.

3. Development Deals

Development deals encompass the construction of new multifamily properties or the redevelopment of existing ones. These projects typically require significant capital investment and entail higher risks compared to other deal types. Investors often target emerging markets or areas with strong growth potential to maximize returns.

Identifying Development Deals:

- Research market trends to identify areas with growth potential.

- Evaluate zoning regulations and development feasibility.

- Assess the financial projections for construction costs and expected returns.

4. Distressed Deals

Distressed deals involve properties in financial distress, such as those facing foreclosure or significant operational challenges. While these deals can present opportunities to acquire properties at a discount, they also carry higher risks and require thorough due diligence.

Identifying Distressed Deals:

- Monitor foreclosure listings and properties in bankruptcy.

- Analyze the property’s operational challenges and financial history.

- Conduct thorough inspections to assess the extent of required repairs.

Recent Trends in Multifamily Syndication

The multifamily syndication landscape is evolving, influenced by various economic factors and changing investor preferences. Here are some recent trends:

Increased Interest in Value-Add Properties: As the market stabilizes post-pandemic, many investors are focusing on value-add opportunities to enhance returns through strategic renovations and repositioning.

Sustainable Development Practices: There is a growing emphasis on sustainability in new developments, with investors seeking properties that incorporate eco-friendly practices and materials.

Rising Interest Rates: The current economic climate, characterized by rising interest rates, is impacting financing options for syndicators. Investors are becoming more cautious and are prioritizing deals with strong cash flow to mitigate risks associated with higher borrowing costs.

Technology Integration: The use of technology in property management and tenant engagement is becoming more prevalent. Investors are looking for properties that leverage technology to enhance operational efficiency and tenant satisfaction.

How to Identify Multifamily Syndication Deals

To successfully identify and evaluate multifamily syndication deals, investors should employ a systematic approach:

- Conduct Market Research: Analyze local market conditions, including supply and demand dynamics, rental trends, and economic indicators.

- Perform Financial Analysis: Review financial statements, cash flow projections, and historical performance data to assess the property’s viability.

- Engage with Industry Professionals: Build a network of real estate professionals, including brokers, property managers, and financial advisors, to gain insights and access to potential deals.

- Conduct Due Diligence: Perform thorough inspections and assessments to identify any operational challenges or necessary improvements.

Schedule a call with us today to discover how to identify the best opportunities!

FAQs

1. What is multifamily syndication?

Multifamily syndication is a process where multiple investors pool their resources to purchase or rehabilitate multifamily properties, allowing for shared risk and access to larger investments.

2. What are the benefits of investing in multifamily syndication?

Investors benefit from diversification, passive income, professional management, and the potential for appreciation in property value.

3. How do I identify a good syndication deal?

Look for properties with strong market fundamentals, thorough financial analysis, and a clear value-add strategy. Engage with experienced syndicators and conduct comprehensive due diligence.

4. What are the risks associated with multifamily syndication?

Risks include market fluctuations, property management challenges, and potential financial losses if the property underperforms.

5. How can I get started with multifamily syndication?

Start by educating yourself about the market, networking with industry professionals, and considering joining syndication as a limited partner to gain experience.

Introduction to Multifamily Real Estate Syndication

Welcome to the exciting world of multifamily real estate syndication, a realm where collaboration, strategy, and smart investing converge to create remarkable opportunities for investors like you. Whether you’re a seasoned investor or just starting, this guide will illuminate the path to potentially lucrative and wise investments in real estate syndication.

Real Estate Syndication

Why Consider Multifamily Real Estate Syndication?

Imagine having the key to unlock larger, more lucrative real estate deals that were previously out of reach. Multifamily real estate syndication does exactly that. By pooling resources with other investors, you gain access to significant commercial real estate opportunities, tapping into markets that promise higher returns and greater growth potential.

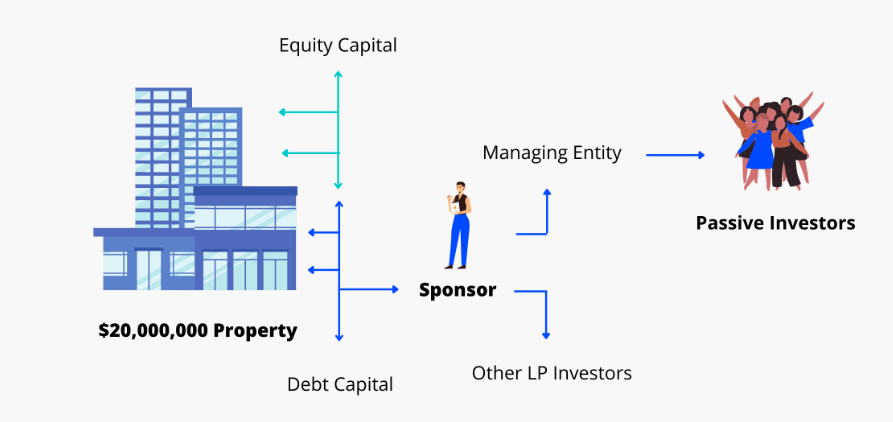

The Synergy of General and Limited Partnerships

At the heart of a real estate syndication is the synergy between two groups: the General Partners (GPs) and the Limited Partners (LPs). The GPs are the strategists and managers, steering the ship with their expertise in property management, while the LPs contribute financially without the hassle of day-to-day management. This structure allows you to invest passively, reaping the benefits of real estate without the typical burdens of property ownership.

The Power of a Limited Liability Company (LLC)

By forming an LLC, both GPs and LPs create a robust framework for holding and managing the property. This legal structure not only streamlines the investment process but also offers you protection and peace of mind.

Consistent Returns and Financial Growth

One of the most attractive aspects of multifamily syndication is the potential for consistent, quarterly cash flow distributions. As a passive investor, you can enjoy a steady stream of income while the property appreciates in value under the expert management of the GPs.

The Final Flourish: Sale and Profit Sharing

The journey culminates with the strategic sale of the property. After enhancing its value and achieving the investment objectives, the property is sold. This is where you, as an investor, see the fruition of your investment – the return of your initial capital and a share in the profits.

Related Investing in Multifamily: A Manual for 2024

Why Multifamily Syndication Stands Out

1. Access to Bigger Deals: Step into the realm of significant commercial properties.

2. Diversification: Spread your investments, reducing risk.

3. Ease of Investment: Share responsibilities, focusing on what you do best.

4. Tax Advantages: Leverage tax benefits to maximize your returns.

Multifamily real estate syndication is more than just an investment; it’s a journey towards financial growth, a pathway to diversify your portfolio, and an opportunity to be part of something bigger. Ready to unlock the door to your real estate investing future? Join the world of multifamily syndication and watch your investment dreams turn into reality.