Real estate investing can be a lucrative way to build wealth, but it also comes with significant tax implications. Understanding the tax benefits of real estate investing is crucial for maximizing your returns and minimizing your tax liability. Investing in real estate is exciting and offers the potential for significant financial rewards. However, to truly get the most out of your investments, it’s essential to understand the tax benefits that come with it. Real estate investors miss out on valuable tax savings simply because they aren’t aware of the opportunities available to them. Learning how to maximize these tax benefits can significantly boost your bottom line.

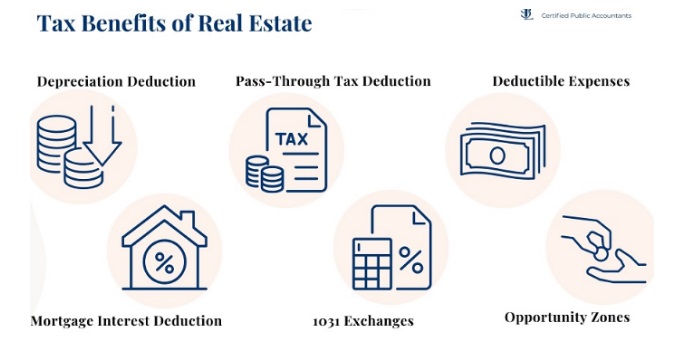

Tax Benefits of Real Estate Investing

Depreciation and Amortization

One of the most significant tax benefits of real estate investing is the ability to depreciate and amortize the value of your property. Depreciation is the process of reducing the value of a property over time due to wear and tear, while amortization is the process of reducing the value of intangible assets such as mortgages and liens. By depreciating and amortizing the value of your property, you can reduce your taxable income and lower your tax liability.

Mortgage Interest and Property Taxes

Another significant tax benefit of real estate investing is the ability to deduct mortgage interest and property taxes from your taxable income. Mortgage interest is the interest you pay on your mortgage, while property taxes are the taxes you pay on your property. By deducting these expenses from your taxable income, you can reduce your tax liability and increase your net income.

Operating Expenses

In addition to mortgage interest and property taxes, you can also deduct operating expenses from your taxable income. Operating expenses include costs such as maintenance, repairs, insurance, and utilities. By deducting these expenses from your taxable income, you can reduce your tax liability and increase your net income.

Passive Income

Real estate investing can also generate passive income, which is income that is earned without actively working for it. Passive income can come from rental properties, real estate investment trusts (REITs), and other real estate-related investments. By generating passive income, you can increase your net income and reduce your tax liability.

Tax Credits

Finally, real estate investing can also provide tax credits, which are credits against your tax liability. Tax credits can be used to offset your tax liability, reducing the amount of taxes you owe. Some common tax credits for real estate investors include the mortgage interest deduction, the property tax deduction, and the energy-efficient home improvement credit.

Conclusion

Maximizing the tax benefits of real estate investing requires a thorough understanding of the tax laws and regulations that apply to real estate investing. By depreciating and amortizing the value of your property, deducting mortgage interest and property taxes, deducting operating expenses, generating passive income, and utilizing tax credits, you can reduce your tax liability and increase your net income. By making informed decisions about your real estate investments and taking advantage of the tax benefits available to you, you can build wealth and achieve your financial goals.

FAQs:

- What are the tax benefits of real estate investing?

- The tax benefits of real estate investing include depreciation and amortization, mortgage interest and property tax deductions, operating expense deductions, passive income generation, and tax credits.

- How do I depreciate and amortize the value of my property?

- You can depreciate and amortize the value of your property by filing Form 4562 with the IRS and claiming the depreciation and amortization deductions.

- What are the tax implications of generating passive income from real estate investing?

- The tax implications of generating passive income from real estate investing depend on your individual tax situation. Passive income can be subject to self-employment taxes, but it can also provide tax benefits such as the mortgage interest deduction and the property tax deduction.

- What are the tax credits available to real estate investors?

- Some common tax credits available to real estate investors include the mortgage interest deduction, the property tax deduction, and the energy-efficient home improvement credit.

- How can I minimize my tax liability as a real estate investor?

- You can minimize your tax liability as a real estate investor by taking advantage of the tax benefits available to you, such as depreciation and amortization, mortgage interest and property tax deductions, operating expense deductions, passive income generation, and tax credits.

As the world evolves, so does the real estate landscape, particularly in the multifamily sector. In 2024, various trends reshape how developers, investors, and residents perceive and engage with multifamily properties. From technological advancements to shifting demographics, here are five emerging trends in multifamily real estate for 2024.

Sustainable Living Spaces:

With a growing focus on environmental sustainability, multifamily properties are adapting to incorporate eco-friendly features and practices. Developers are increasingly integrating renewable energy sources such as solar panels, implementing energy-efficient appliances, and incorporating green spaces within communities. Additionally, initiatives like water conservation measures and waste reduction strategies are becoming standard in multifamily developments. Sustainable living spaces appeal to environmentally conscious tenants and contribute to cost savings and long-term value for property owners.

Smart Building Technologies:

Advancements in technology are revolutionizing multifamily real estate with the integration of smart building technologies. From smart thermostats and automated lighting systems to keyless entry and remote property management platforms, these technologies enhance convenience, security, and efficiency for residents and property managers. IoT (Internet of Things) devices enable real-time monitoring and control of various building systems, optimizing resource usage and improving overall tenant experience. As the demand for connected living spaces grows, expect widespread adoption of smart building solutions across multifamily properties in 2024 and beyond.

Flexibility in Design and Amenities:

The preferences and lifestyles of renters are evolving, driving the need for greater flexibility in multifamily property design and amenities. Developers focus on creating versatile living spaces that accommodate diverse tenant demographics and changing needs. This includes flexible floor plans that easily adapt to different living arrangements, such as co-living or multigenerational housing setups. Additionally, communal amenities like coworking spaces, fitness centers, and pet-friendly facilities are gaining popularity as tenants prioritize convenience and social connectivity. By offering a mix of amenities and flexible living options, multifamily properties can attract a wider range of tenants and foster a sense of community.

Rise of Urban Suburbs:

Urban suburbs are gaining traction as more people seek the benefits of suburban living without sacrificing urban conveniences. These mixed-use developments combine elements of both urban and suburban environments, offering walkable neighborhoods with access to retail, dining, and entertainment options. With the rise of remote work and flexible schedules, urban suburbs provide an attractive alternative for renters looking to balance city living and suburban tranquility. Multifamily developers are capitalizing on this trend by investing in suburban markets with strong job growth and transportation infrastructure, creating vibrant communities that cater to modern urban dwellers.

Emphasis on Health and Wellness:

The COVID-19 pandemic has heightened awareness of health and wellness concerns, prompting multifamily properties to prioritize resident safety and well-being. In 2024, expect to see an increased focus on health-centric design features and amenities, such as air purification systems, outdoor recreation areas, and wellness programming. Properties that promote physical and mental well-being will appeal to health-conscious tenants seeking a holistic living experience. Additionally, integrating telehealth services and fitness technology platforms allows residents to prioritize their health from the comfort of their homes. By prioritizing health and wellness initiatives, multifamily properties can differentiate themselves in a competitive market and attract discerning renters.

Conclusion:

The multifamily real estate landscape is evolving rapidly, driven by technological innovations, demographic shifts, and changing consumer preferences. In 2024, sustainability, technology, flexibility, urban suburbs, and health and wellness will emerge as key trends shaping the future of multifamily properties. By embracing these trends, developers and investors can capitalize on opportunities to create innovative, resilient communities that meet the evolving needs of tenants in the years to come.